Today technology is available to cure critical illnesses as well as basic health concerns. But, with this advancement comes the shooting prices of health care services which are beyond the reach of common man. Here, health insurance comes as a relief to rescue us in the difficult times of hospitalization. This includes in-patient treatments, pre and post hospitalization charges, day care procedures, domiciliary treatments, etc.

With rising medical costs, the importance of health insurance policy cannot be overstated. Check the cost of a two day's hospitalization for a regular ailment and then compare it with your company's insurance coverage. When you will retire or change a job, your corporate health plan will cease to exist. So it is worthwhile to buy an individual health plan.

Sadly, India is grappling with life threatening diseases. The effect of these diseases is felt on the productive workforce from 35-65 years. Also, heart diseases among Indians occur five to ten years earlier than in any other population around the world. Sedentary lifestyles lead to life-threatening diseases like cancer and heart diseases which are critical and impose heavy expenditure burden on families. It is therefore imperative to insure oneself timely. Moreover, health insurance policies offer annual health checks ups to encourage health awareness.

Buying health insurance at a young age ensures there is no scope for pre-existing diseases as you will be covered early, and any diseases diagnosed later will be covered automatically.

You can get exemption for paying the premium under Section 80D of the Insurance Act. This year, India's Finance Minister Mr. Arun Jaitley has increased the limit of deduction in health insurance premium to Rs 25,000 from Rs 15,000. For senior citizens, the new limit is Rs 30,000.

We often set goals and save regularly to meet those goals but a medical emergency may play havoc in an individual's financial planning. With Health Insurance policy, you may be rest assured of attaining your financial goals.

New health plan cover you for day care procedures and OPD, not just serious hospitalization. Depending on your level of cover, a health policy helps you pay for services such as ambulance, day-care procedures in addition to a number of non-hospital related services such as chiropractic, dental, physiotherapy, optical, dietary advice and some alternative therapies like Ayurveda and Homeopathy as well.

Health insurance covers medical expenses for illnesses, injuries and conditions. But, unlike a plan through an employer, individual health insurance is something you select and pay for on your own.

A family floater health insurance, as the name suggests is a plan that is tailor made for families. It is similar to individual health plans in principle; the only difference is that it is extended to cover your entire family.

Life threatening critical illnesses like paralysis, cancer, heart diseases, brain tumours, not only leave the patient unable to earn but are also very expensive in nature. Many families get devasted financially and emotionally. A critical illness policy covers the insured in the event of such cases.

Senior citizen health insurance plan is a necessity, especially when you are planning to retire and live on pension or interest income from savings.

We often set goals and save regularly to meet those goals but a medical emergency may play havoc in an individual's financial planning. With Health Insurance policy, you may be rest assured of attaining your financial goals. A sudden medical emergency can result in a financial crisis. To avoid this, it is prudent to take a comprehensive senior citizen mediclaim insurance policy. These senior citizen health insurance policies are for people aged between 65 years and 80 years.

Insurance claims throughout are settled by the insured or third party administrator. In case of hospitalisation, whether cashless or reimbursement, your TPA would be your point of contact. Always contact your service provider for any claim request.

These are hospitals listed area wise, which are empanelled with your insurer to provide cashless hospitalization should the need arise.

Before and after hospitalization, depending on the no. of days mentioned in the policy, the expenses are covered by the insurer.

Your insurer will have a list of network hospitals which are covered to provide cashless treatment should there be hospitalization. The insured need not pay hospital bill once approved, as it is already covered.

If the policy holder does not register any claims in the whole year, he is entitled to No Claim Bonus (NCB). This is provided to insured as a deduction in renewal premium amount or increased sum assured.

Free Health Check up facility is offered by some insurers if there are no claims registered, depending on the policy type.

Today technology is available to cure critical illnesses as well as basic health concerns. But, with this advancement comes the shooting prices of health care services which are beyond the reach of common man. Here, health insurance comes as a relief to rescue us in the difficult times of hospitalization. This includes in-patient treatments, pre and post hospitalization charges, day care procedures, domiciliary treatments, etc.

While minor accidents can cause temporary hurdles, major ones can lead to disability for life or even demise. With a view to providing certain relief, insurance companies have devised various policies that serve as true life savers when met with an unfortunate circumstance.

Give yourself a minute to think about what will happen to your dependents if you were disabled because of an accident? There will be no monthly income, no cash inflows but expenses will continue to rise. In such case, an accident insurance policy will help you bring these expenses under control.

Accidental death coverage gives compensation on the policyholder's death caused by bodily injury resulting out of an accident. The nominee will receive entire sum assured offered by the insurer.

If the accident causes permanent or total disability, then 100% of the sum insured is payable to the policyholder.

If policyholder's body part has been dismembered or severed in the accident then the person can claim the sum insured.

Funeral expenses can be claimed in case of accidental death. Expenses incurred for transportation of policyholder's dead body from the accident spot to the residence place is covered.

Monetary relief offered to the patient on daily basis on hospitalization.

A certain amount of the policy sum is payable, when an accident results in hospitalization & the victim is being treated for burn injuries.

Some policies may offer bonuses to the dependent kids of the policyholder. This becomes helpful in case of the death of the policyholder or extension of treatment period.

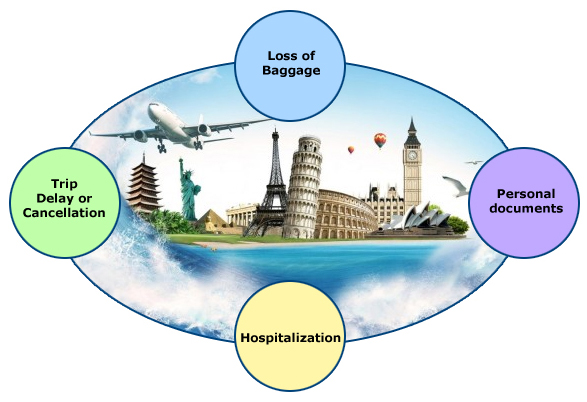

Traveling has become an integral part of our modern society. We could be traveling for reasons like a business trip or much awaited vacation. But one cannot deny the fact that there are several things that could go wrong when one travels. Disruptions like cancellation of flights, loss of baggage, medical emergency- are some of the unforeseen events that could catch you off guard. So whether you are off to your favorite destination for a holiday or going on a business trip - an adequate & complete travel insurance is a must have.

Various plans are available according to every individual's travel needs.

Under this plan, employees of an organization can receive coverage for both domestic and international trips.

In this type, coverage is offered for death, medical emergencies, permanent disability, personal liability, delays, and lost/theft of checked-in luggage.

It gives a comprehensive coverage for medical costs overseas, trip delays, loss of travel documents besides the regular coverage.

This plan covers people in the age group 61-70 years. Besides providing general advantages, it also gives cashless hospitalization coverage and dental treatments.

This comprehensive cover is suitable for expenses incurred because of medical treatment, study interruptions and passport loss.

Under individual travel plan, insured is covered against trip curtailment, trip cancellation and theft

It covers baggage loss, hospitalization expenses and other incidental costs. The claim disbursement is not difficult with less paperwork involved.

This type of travel insurance is offered to frequent travelers so that they don't have to apply for insurance every-time they travel.

As the name suggest, this type of cover is provided only for the duration of the trip. It also covers medical & non-medical emergencies along with baggage loss situations.

The basic worries of travellers include stolen baggage, lost passports, cancelled flights and trip delays. These mishaps can spoil perfectly planned vacations. Do not let such incidences ruin the entire journey.

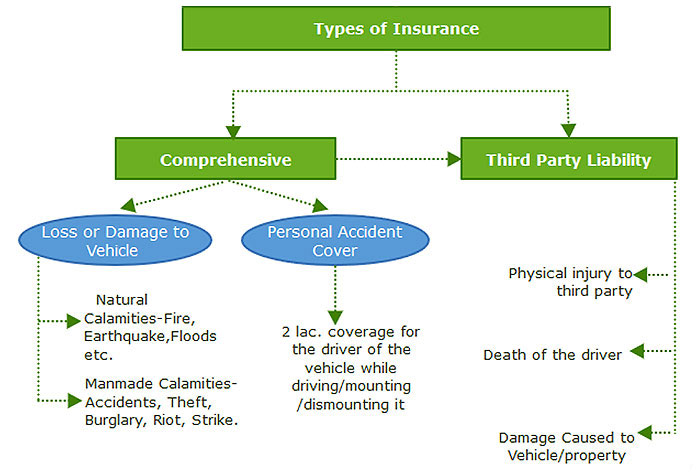

Auto insurance policy is mandatory for vehicle owners as per Indian Motor Vehicles Act 1988. This Plan is designed to give coverage for losses which insured might incur in case his gets stolen or damaged. The amount of Auto insurance premium is decided based on the Insured Declared Value of a car. The premium will increase, if you raise the IDV limit and vice versa.

Auto insurance is mandatory for all vehicles that ply on roads-like car, trucks, etc. The prime objective of this type of insurance is to provide complete protection & coverage on physical damage or loss from man-made & natural disasters. According to Indian Motor Act 1988, an auto insurance policy is mandatory for every automobile owner in the country. Hence, purchasing an auto insurance is not just a necessity, it is mandatory by law.

| Accident | Self-Ignition | Earthquake |

|---|---|---|

| Fire | Transit by Rail, Road, Air & Elevator | Riot & Strikes and / or Malicious Acts |

| Lightening | Theft | Flood, Cyclone |

| Explosion | Terrorism | Inundation |

This insurance gives coverage against accidental damage or losses to the holder's vehicle or third party. The amount of premium depends upon the make of the car, manufacturing year, value & state of registration.

This type of insurance is for scooters, bikes & features are similar to that of four-wheeler insurance.

It financially protects the policyholder against damage of insured's own car. Collision coverage pays the policyholder for damage caused because collision which generally occurs due to an accident.

This type of coverage offers complete package policy wherein any damages to the vehicle will be covered up to the Insured Declared Value. Any third party property damage or third party injury/death can be covered. Policyholders feel less stressful as it gives end-to-end coverage.

Under the Motor Vehicles Act, third party liability coverage is legally mandatory. This type of auto insurance offers coverage against all legal liabilities to a third party caused when insured vehicle owner is at-fault. It insures injury/damage caused by policyholder to third person/property

Add-on riders doesn't take the depreciation value of the parts & allows you to receive the entire claim amount. It is generally available for cars under three years & allows eligibility to claim full amount for replacing/changing any damaged parts of your vehicle.